NASDAQ weekly GAMEPLAN 2 March 2025

This is a daily chart of the NDQ100 (Nasdaq 100) index, published on TradingView, using smart money concepts like liquidity sweeps, order blocks, and Fibonacci retracement levels. Key Observations: Conclusion: The market appears to be in a bearish correction phase, where a short-term bounce is likely before further declines. Traders might look for short positions…

USDJPY Technical analysis 2 March 2025

This chart is a 4-hour (240-minute) price analysis of the USD/JPY currency pair, published on TradingView. It incorporates technical analysis concepts such as supply and demand zones, order blocks (OB), and liquidity sweeps. Key Observations: This chart suggests a short-term bullish move followed by a significant bearish reversal, aligning with smart money concepts like liquidity…

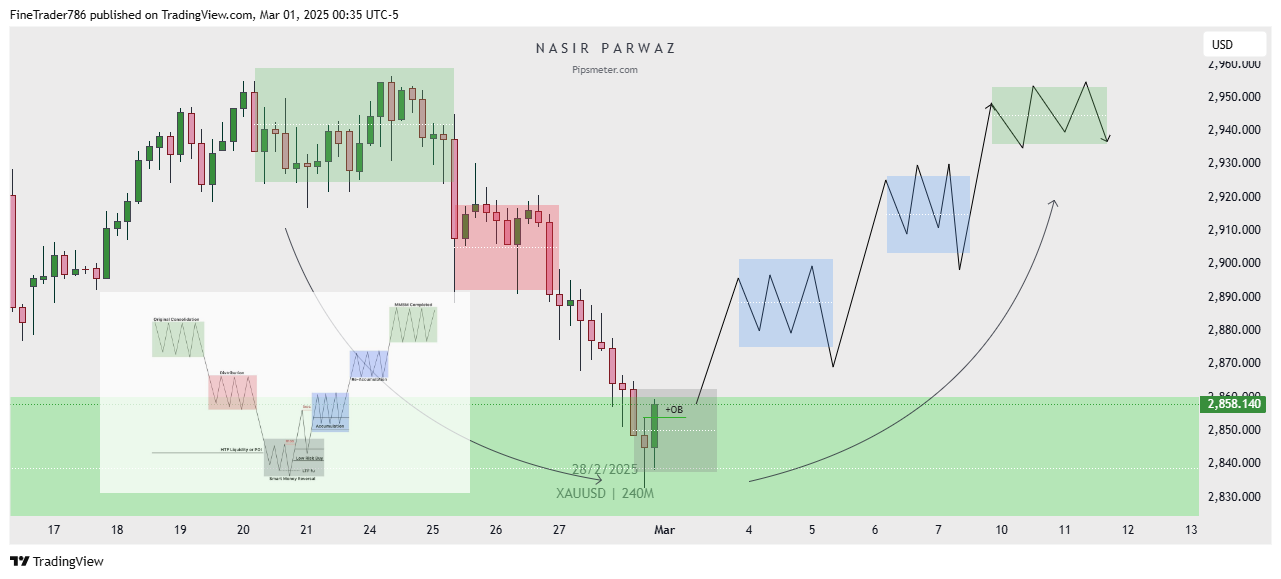

XAUUSD technical analysis 2 March 2025

As of March 1, 2025, gold prices have experienced significant volatility, influenced by various economic factors and geopolitical events. The XAU/USD pair reached an all-time high of $2,956 on Monday but has since corrected, trading at approximately $2,864.33 per ounce, marking a 2.5% decline for the week. Reuters Key Influencing Factors: Technical Analysis: Technical indicators…

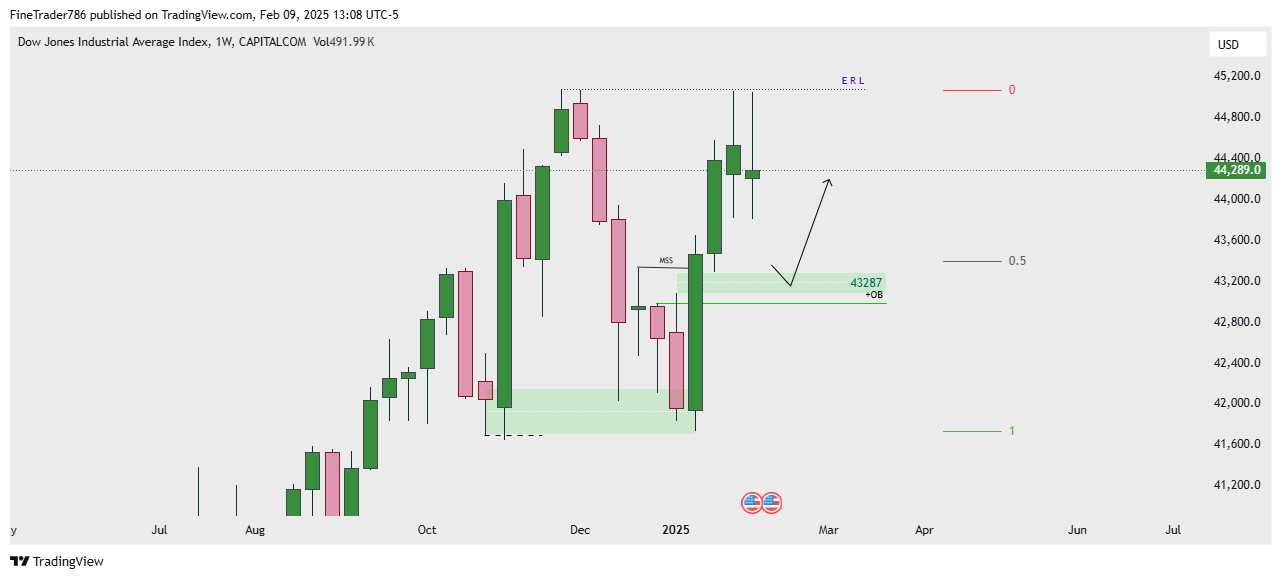

US30 chart Technicals 09 Feb 2025

This chart represents the Dow Jones Industrial Average Index (US30) on the Weekly (1W) timeframe, showing a technical analysis outlook. Key Observations: Projected Price Movement:

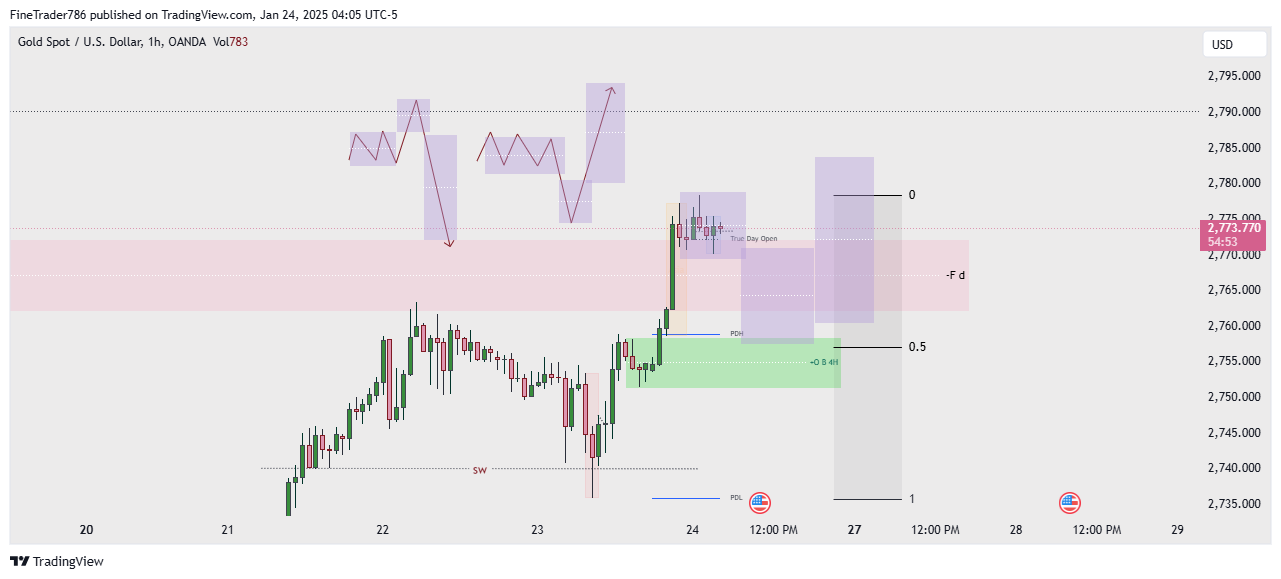

XAUUSD (GOLD) Weekly Update 26 Jan 2025

Gold ia going super Bullish and the only thing which give it a daily FVG for sell and previous daily candle is closed inside the FVG. But it can be a trap. We will take buy entry inside Bullish POI

EUR USD Update 26 Jan 2025

Euro USD is also looking Bullish. If we see EURUSD in weeky then price recently created a bullish IFVG which is also aligned with a 4H OB. Now we will wait for the price to touch the POI inside Time frame then we will wait for a clear confirmation in m15.

Gold Update 24 DEC 2025

Gold give a good bullish move in the morning when it forming a new day candle. Now price is still consolidating in London session. Because today is Friday which is most of the time a reversal day when all previous week is bullish then Friday will be a reversal day. I am expecting reversal buy…

Gold Short term Day Trade idea

I am still bullish on Gold, I am expecting íf Gold give us good confirmation in the 4H fvg+OB in m15 then we will take 1:2 RR trade easily. The ideas given on this website is totally for Knowledge and learning purpose, I am not responsible for any loss. So it is not a financial…

GBPJPY possible Move

According to ICT daily bias of GBPJPY’s daily bias is bullish if 1H confirmation happen and price give us good confirmation in m5 also. Remember daily bias is just a narrative, the main thing is confirmation in the killzone times. It will give good reward if it happened in the london killzone (LOKZ). In weekly…

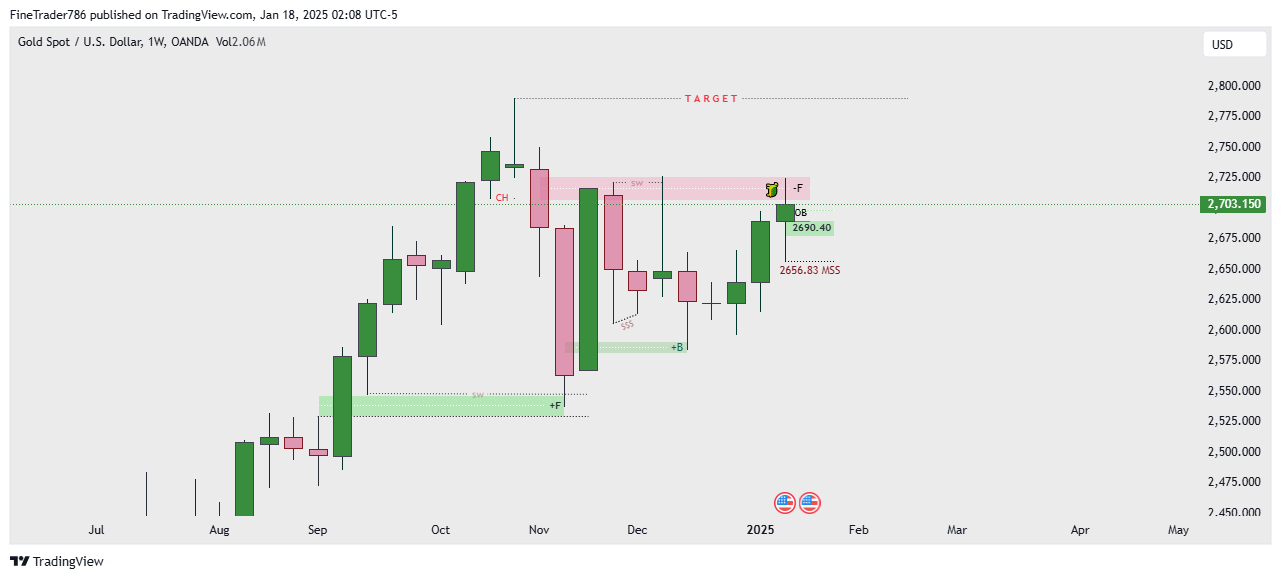

GOLD XAUUSD Forex Market Update 20 Jan 2025

Gold is inside its Premium zone and also in bearish FVG again according to daily PD array. We also see a sell rejection on friday and full day was bearish and all sell setups hit their Target successfully. Now the plan is if we will find a bullish confirmation at 2690 then we will again…