As of March 1, 2025, gold prices have experienced significant volatility, influenced by various economic factors and geopolitical events. The XAU/USD pair reached an all-time high of $2,956 on Monday but has since corrected, trading at approximately $2,864.33 per ounce, marking a 2.5% decline for the week.

Key Influencing Factors:

- U.S. Inflation Data: Investors are closely monitoring upcoming U.S. inflation reports, particularly the Personal Consumption Expenditures (PCE) index, which may impact Federal Reserve monetary policy decisions. Reuters

- Geopolitical Developments: Trade tensions, especially concerning U.S. tariffs, have contributed to market uncertainty, influencing gold’s appeal as a safe-haven asset. City Index

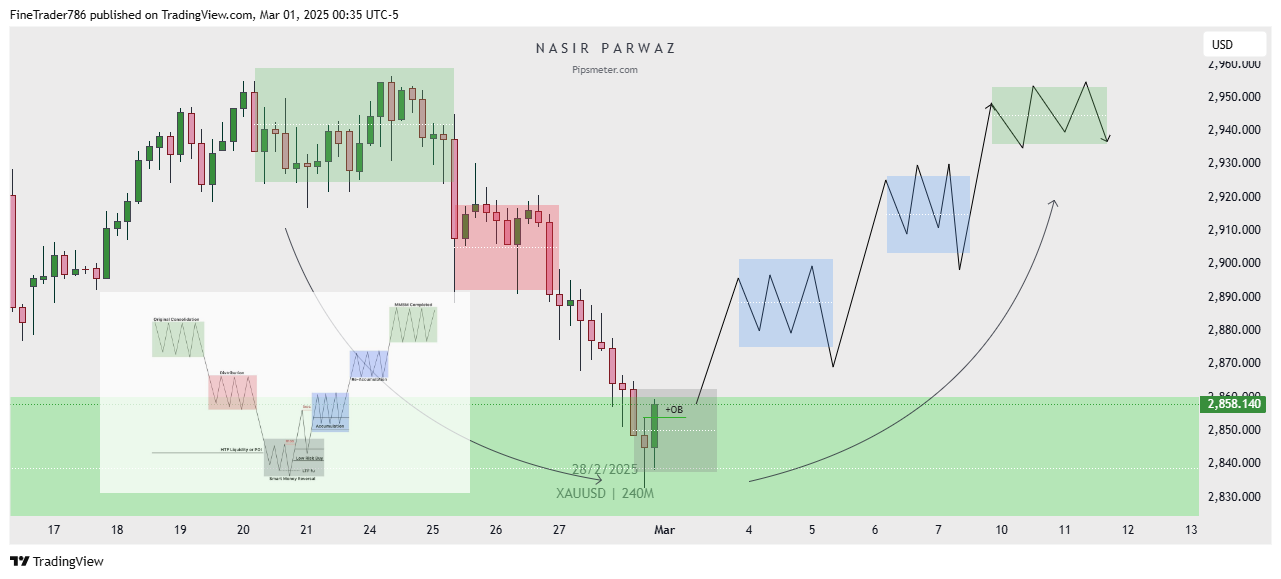

Technical Analysis:

Technical indicators suggest a bearish trend for gold:

- Moving Averages: Short-term moving averages are signaling a sell, while longer-term averages indicate a buy. TipRanks

- Relative Strength Index (RSI): The RSI stands at 51.23, indicating a neutral market sentiment. TipRanks

Forecast for the Upcoming Week:

Analysts anticipate continued volatility for gold in the coming week, with potential support levels around $2,820 to $2,800. Resistance is expected near the $2,950 mark. The market’s direction will largely depend on the release of U.S. inflation data and developments in global trade relations.

Investment Considerations:

For investors seeking exposure to gold, exchange-traded funds (ETFs) such as SPDR Gold Shares (GLD) and iShares Gold Trust (IAU) offer liquid alternatives to physical gold.

Given the current market dynamics, it’s crucial to stay informed about economic indicators and geopolitical events that could influence gold prices. Consulting with a financial advisor is recommended to align investment decisions with individual risk tolerance and financial goals.

Waqar Nawab

March 1, 2025Good job bro keep it up

Shah G

March 1, 2025Wowwwww great charting with explanation